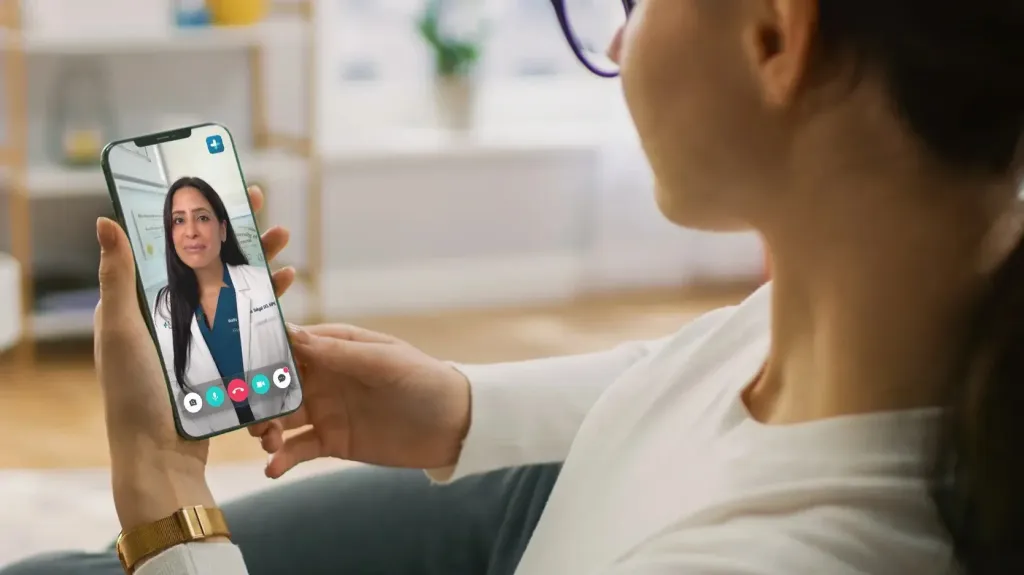

The weight management program has become one of the key drivers of LifeMD’s telemedicine business. / Photo: LifeMD

Shares of LifeMD, a company that provides online healthcare services and offers a web platform for streamlining workplace tasks, surged nearly 20% early in the day today, March 11. The trigger was the company’s “great fourth quarter,” in particular, that of the weight management program. From April, LifeMD will start working with Medicare, which is expected to be a “significant growth driver” for its business.

Details

LifeMD jumped nearly 20% in the opening minutes of trading today to reach $5.12 per share.

Investors reacted to the company’s financial results for the fourth quarter. Consolidated revenue grew 43% year over year to $64.3 million. Adjusted EBITDA soared 78% to $9 million, with the telemedicine segment’s bottom line skyrocketing 396% to $5.9 million.

What drove the results

LifeMD is especially pleased with the growth of its weight management program, said CEO Justin Schreiber, as quoted in the earnings announcement. The program includes consultations, remote monitoring, diagnostic testing, and prescription services.

Schreiber says a “significant growth driver” for this segment is the Medicare launch scheduled for April 1. Medicare, the U.S. federal health insurance program for the elderly, “ultimately will cover GLP-1 medications for eligible beneficiaries,” Schreiber expects.

For customers without insurance coverage, LifeMD has launched a joint initiative with LillyDirect, a division of pharmaceutical giant Eli Lilly, so the weight-loss medicine Zepbound (tirzepatide) can be ordered from LillyDirect pharmacies at a discounted price.

Beyond telemedicine, LifeMD also provides workplace and document services through WorkSimpli. In the fourth quarter, this business returned to growth, noted LifeMD CFO Marc Benathen. Its revenue increased 6% year over year to $14.4 million.

LifeMD is “well positioned for another year of record growth and profitability,” Benathen believes. He guides for revenue to reach $265-275 million this year, which would be a 25-29% increase versus 2024. That, however, would be a slowdown, as top-line growth was 39% in 2024.

Analyst insights

LifeMD has five “buy” ratings from coverage analysts and one “hold,” according to MarketWatch. Their average target price is $11.58 per share, 2.7 times the stock’s closing price yesterday, March 10.